Social Security 101

Social Security is complicated, and the details are often misunderstood even by those who are already receiving benefits. If you’re looking forward to receiving your Social Security benefits, whether in one year or 30 years, you may be curious about some of the basic rules and options and how they might affect your financial future.

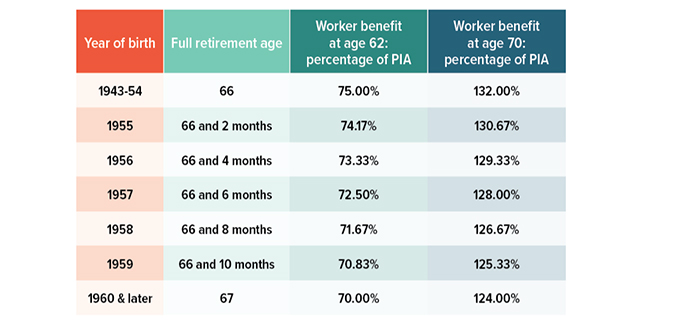

Full retirement age (FRA). Once you reach full retirement age, you can claim your full Social Security retirement benefit, also called your primary insurance amount or PIA. FRA ranges from 66 to 67, depending on your birth year (see chart).

Filing early. You can claim your Social Security worker benefit as early as age 62. However, your benefit will be permanently reduced if you file before your FRA. At age 62, the reduction would be 25% to 30%, depending on your birth year. Your benefit may be further reduced temporarily if you work while receiving benefits before FRA and your income exceeds certain levels. (When you reach FRA, you would regain any benefits lost due to excess earnings through an adjustment.)

Filing later. If you do not claim your benefit at FRA, you will earn delayed retirement credits for each month you wait to claim up to age 70. This will increase your benefit by two-thirds of 1% for each month, or 8% for each year you delay. There is no increase after age 70.

Spousal benefits. If you’re married, you may be eligible to receive a benefit based on your own earnings history or a spousal benefit based on your spouse’s work record. The maximum spousal benefit, if claimed at your full retirement age, is 50% of your spouse’s PIA (regardless of whether he or she claimed early) and doesn’t include any delayed retirement credits. If you claim a spousal benefit before reaching your FRA, it will be permanently reduced.

Survivor benefits. If your spouse dies, you can claim a reduced survivor benefit as early as age 60 or a full survivor benefit — 100% of your deceased spouse’s PIA and any delayed retirement credits — if you wait until your full retirement age. If you are eligible for a survivor benefit and one based on your own work record, you could claim a survivor benefit first and switch to a benefit based on your work record at your FRA or later, if it would be higher.

Claiming Early or Late

Divorced spouses. If you were married for at least 10 years and are unmarried, you can receive a spousal or survivor benefit based on your ex’s work record. If your ex is eligible but has not applied for Social Security benefits, you can still receive a spousal benefit if you have been divorced for at least two years.

Dependent benefits. Your dependent child may be eligible for benefits after you begin receiving Social Security if he or she is unmarried and meets one of the following criteria: (a) under age 18, (b) age 18 to 19 and a full-time student in grade 12 or lower, (c) age 18 or older with a disability that started before age 22. The maximum family benefit is equal to about 150% to 180% of your PIA, depending on your situation.